What are DEX Aggregators?

Every time a major crypto exchange experiences a hack, there is an inevitable decline in trust toward centralized platforms. The collapse of FTX, one of the industry’s most highly regarded trading platforms that had raised billions from investors and registered over five million users by the beginning of 2022, revealed financial mishandling so massive that the total cost to investors and customers has not yet been determined. However, fleeing from centralized exchanges (CEX) to decentralized finance (DeFi) in the aftermath of these incidents can end up being just as traumatizing.

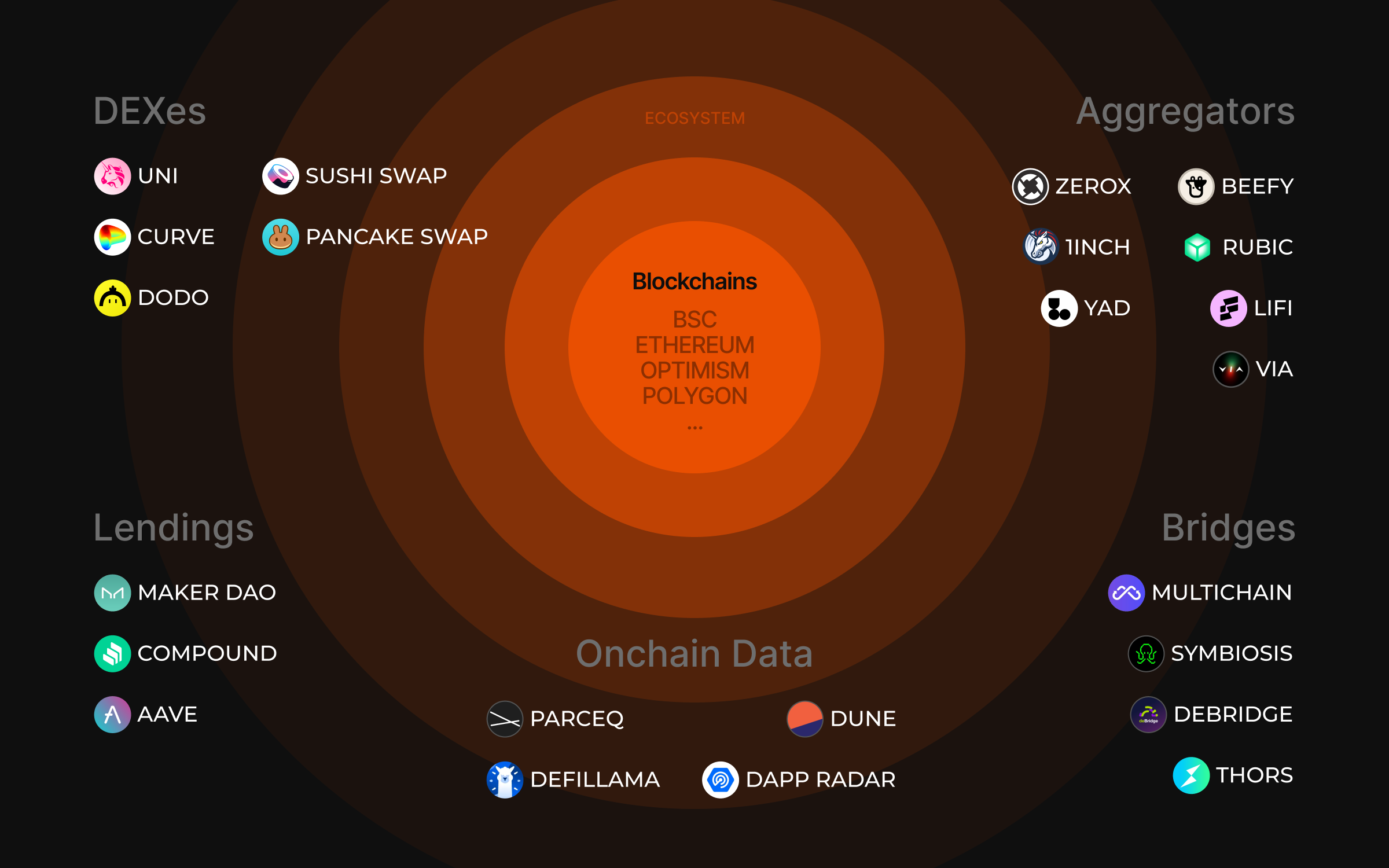

Ex-CEX users often face daunting challenges once outside their familiar environment and as they first encounter the diversity of new ways to invest. DEXes, L2 blockchains, cross-chain aggregators, multichain aggregators, cross-chain bridges... Where do you even start?

With over 300 DEXes to choose from, it is easy to get overwhelmed as you try to research which offers the best trading opportunities. The fact that DEXes differ from CEXes in terms of functionality and user interfaces only makes it more difficult to get started.

While a magic pill doesn’t exist, there should be a single comprehensive DeFi service that provides a user-friendly interface and at least a slightly more welcoming experience for users entering the DeFi space. Several development teams in this niche of the industry have been working hard to bring the entirety of DeFi’s liquidity under a common standard that is accessible to the vast majority of the crypto traders. And as a result of their efforts, anyone with a self-custody wallet can now use the power and convenience of DEX aggregators.

What are DEX aggregators?

A DEX aggregator is a decentralized application that scrapes the liquidity of many various DEXes across the DeFi landscape to provide traders optimal gas fees, swap rates, slippage and overall returns, outperforming any individual DEX. Let’s dive deeper into the different types of DEX aggregators currently available.

Multichain DEX aggregators like 1inch, Matcha, and Paraswap bring together the liquidity pools of DEXes across various blockchains. However, these aggregators allow their users to swap tokens only within a single blockchain — e.g., on Polygon, or on Optimism, or on Ethereum, etc. Those using a multichain aggregator often need to move from one chain to another in order to swap tokens on their native chain. Despite this limitation, many users find the UI of multichain DEX aggregators to be user-friendly.

Cross-chain DEX aggregators, such as Transferto.xyz on the Li.fi protocol, as well as Rubic and Rango, also unite DEXes’ liquidity pools across various blockchains. They are distinct, however, from multichain DEX aggregators in that they allow users to directly swap tokens originally minted on one chain for tokens on another chain without additional steps — which could be incredibly helpful for some users’ trading strategy.

So, which of these innovations is better? Well, it turns out there are arguments for and against both. Ethereum co-founder Vitalik Buterin, for example, has expressed his view on the matter, stating that cross-chain bridges present greater risks when compared to multichain solutions.

“Even if there's a perfect ZK-SNARK-based bridge that fully validates consensus, it's still vulnerable to theft through 51% attacks,” he said.

Despite Vitalik’s concerns, the market is looking for solutions that connect the disparate blockchain ecosystems of today. Emin Gün Sirer, founder and CEO of Ava Labs, believes that the Avalanche Bridge represents a major leap in cross-chain technology, offering vastly improved experiences for both users and developers across the Avalanche community. Emin views it as a driving force for the next phase of growth on Avalanche, setting a new standard for secure and efficient cross-chain interoperability.

Why do DEX aggregators exist

DEX aggregators are here to address a number of potential complications you come across, even if you aren’t a trader.

Fragmented liquidity, market diversity, high transaction fees, security, and trust are all issues vexing the development of decentralized finance. In what way, though?

Let’s begin with fragmented liquidity, which affects the price of the swap.

- When there is insufficient liquidity of a desired asset on an individual DEX, executing an order can result in a significant price impact. Using a DEX aggregator, however, liquidity of any specific asset is scrapped from different liquidity sources via splitting the order into smaller trades, thereby providing the best possible rate.

- Due to the way DEXes are designed, swapping tokens is rarely instantaneous. Depending on the size of the trade and how much liquidity is utilized, the cost and speed of swaps can fluctuate. But this presents risk when trading in markets as volatile as crypto. During the time of the order’s execution, the price of the asset might slip, resulting in negative slippage that the trader has to swallow. However, DEX aggregators allow you to set your slippage tolerance, which will work with all DEXes and revert the trade if the slippage exceeds your accepted limit.

- Finally, there are always slight price differences throughout the market. It takes a human time and effort to manually check prices across different exchanges, but an aggregator is able to pull real-time data from hundreds of sources each second, resulting in the best price possible. As Anton Bukov, the CTO of 1inch, explained in a blog post:

“The first customers of 1inch were myself and Sergej. It was exhausting and inefficient to manually check for the best trading prices on all the DEXs — Uniswap, Kyber, 0x — before placing a trade. We — like all crypto users — needed an elegant algorithm to search every DEX for the best trading price and instantly deliver an optimized trade.”

In theory, the wider the variety of DEXes, the greater the market diversity and levels of healthy competition. Counterintuitively, this diversity may also be adding unnecessary steps to the trading process. DEX aggregators scrap liquidity from Uniswap V1, Uniswap V2, Balancer, Curve, SushiSwap, Chai, Kyber, Oasis, Mooniswap, Bancor, and many more platforms in search of the lowest fees and prices currently on the market, collecting and sorting the data so you don’t have to.

Transaction fees on many of the most widely used DEXes are often prohibitively expensive due to the high congestion on the Ethereum blockchain. The increased competition among network participants to get their data and functionality included in each block’s limited capacity results in higher fees for every transaction. There are, of course, alternatives on different chains — say, PancakeSwap on Binance Smart Chain (BSC) — but exploring and migrating to another blockchain requires research and knowledge. Meanwhile, DEX aggregators are built in such a way that they automate nearly all the complicated processes for the benefit of the end user.

Because open-source code and transparent smart contracts are considered as standards in the DeFi community, many anonymous crypto entrepreneurs simply replicated or imitated existing projects on other various blockchains. Neither security audits nor transparent technologies have been sufficient to solve the problem. That said, it’s worth acknowledging the uncertain security many experience while trading in a trustless environment. How can they really know whether an individual DEX can be trusted — or even an individual an DEX aggregator, for that matter. But just as the collapse of a major CEX pushed those disaffected to explore new boundaries of trust and safety, further innovations like DEX aggregators are already on the next frontier testing what else is possible.

So, how does a DEX aggregator work? Check out the next article in the series to find out!